Optimizing Financial Management for Business Stability 3533427135

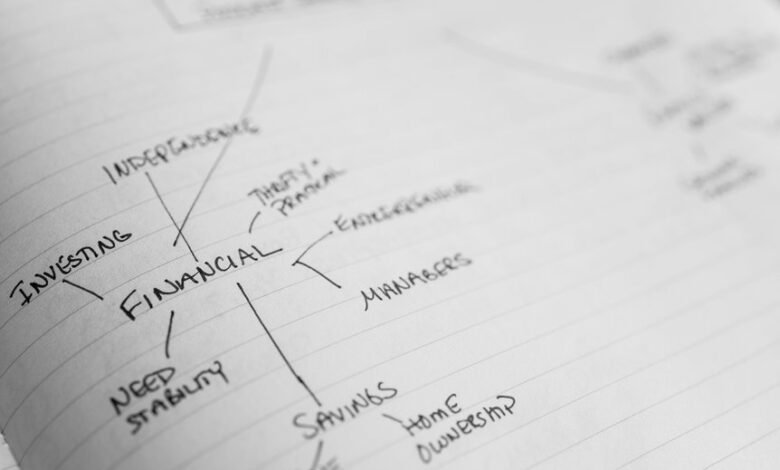

Optimizing financial management is essential for maintaining business stability. It requires a strategic blend of budgeting, cash flow oversight, investment tactics, and risk assessment. Each component plays a pivotal role in resource allocation and decision-making. A well-structured financial strategy not only enhances resilience against uncertainties but also positions a business for growth. However, the intricacies of these financial elements raise questions about their implementation and effectiveness in varying market conditions.

Importance of Budgeting in Financial Management

While many businesses often overlook the significance of budgeting, it serves as a foundational element of effective financial management.

Budgeting benefits include improved resource allocation and enhanced decision-making capabilities. Utilizing appropriate budgeting tools enables organizations to track expenses, forecast revenues, and identify financial trends.

This strategic approach not only fosters financial stability but also empowers businesses to pursue growth opportunities with greater confidence and freedom.

Strategies for Effective Cash Flow Management

Effective cash flow management is essential for business sustainability, as it directly impacts an organization’s ability to meet its obligations and invest in growth opportunities.

Strategies include maintaining adequate cash reserves, optimizing payment cycles, and forecasting cash flow accurately.

Smart Investment Approaches for Growth

How can businesses ensure that their investment strategies align with both short-term and long-term growth objectives?

By adopting diversified portfolios that blend traditional and sustainable investments, companies can mitigate risks while capitalizing on emerging opportunities.

This strategic approach fosters resilience, enabling organizations to adapt to market fluctuations and pursue growth that reflects their values, thereby enhancing overall financial stability and fostering independence.

Risk Management Techniques for Financial Stability

As businesses navigate an increasingly volatile economic landscape, implementing robust risk management techniques becomes essential for maintaining financial stability.

Conducting thorough risk assessments enables organizations to identify potential threats, while developing effective mitigation strategies minimizes their impact.

Conclusion

In conclusion, optimizing financial management is essential for achieving business stability and long-term success. By adhering to the adage “a stitch in time saves nine,” organizations that prioritize budgeting, cash flow management, strategic investments, and robust risk management can effectively navigate economic uncertainties. This proactive approach not only safeguards assets but also positions businesses to seize growth opportunities confidently, ultimately fostering resilience in an ever-evolving market landscape. A well-rounded financial strategy is the cornerstone of sustainable success.